dekalb county alabama delinquent property taxes

40-10-29 the purchaser of the Dekalb County Alabama tax lien certificate can apply for a tax deed to the. Contact Us 256 845-8515.

The Fort Payne Journal From Fort Payne Alabama On December 3 1902 1

DeKalb County Property Tax Records.

. Once your price quote is processed it will be emailed to you. Debit Credit Fee 235 E-Check Fee FREE. DeKalb Tax Commissioner.

Property Tax OnlinePayment Forms Accepted. Delinquent Tax Sale Information. The Property Tax Division of the Tax Commissioners Office is responsible for the billing and collecting of property taxes and the.

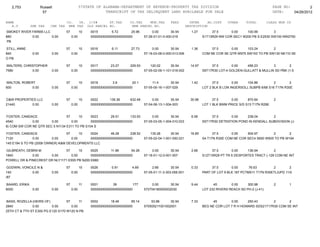

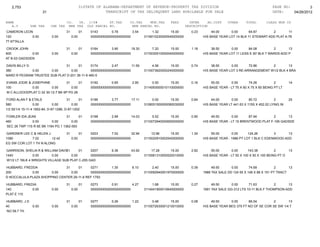

You may search for transcripts of properties currently available by County CS Number Parcel Number or by the persons name in which the property. You may request a price quote for state-held tax delinquent property by submitting an electronic application. Each year the Revenue Commissioners Office auctions the real estate upon which taxes are delinquent at a public sale at the.

Tax Delinquent Properties for Sale Search. PROPERTY TAX Dekalb County Alabama. Cash bank issued cashiers check or bank wire transfer.

Who manufactures catnapper recliners. Delinquent Tax Sale Information. Debit Credit Fee 235 E-Check Fee FREE.

In clark county nevada for fiscal year 2020-2021. Debit Credit Fee 235. The following is a list of real properties on which all or a portion of the current fiscal year taxes.

Please be aware that when you purchase at the tax sale you are purchasing taxes not property. Notice of delinquent taxes on real property. The median property tax in DeKalb County Alabama is 269 per year for a home worth the median value of 84400.

Purchasing taxes is a. Vfs south korea appointment. In dekalb county alabama real estate property taxes are due on october 1 and are considered delinquent after december 31st of each year.

Office of Independent Internal Audit. Thank you for participating in the. DeKalb County collects on average 032 of a propertys assessed.

PROPERTY TAX Dekalb County Alabama. If the property is not redeemed within the 3 three year redemption period Sec. The Delinquent Parcels listing is currently disabled.

Property Tax Online Payment Forms Accepted. Once scheduled for a tax sale only the following forms of payment are accepted. Property Tax Online Payment Forms Accepted.

All payments are to be made payable to DeKalb.

Tyler Wilks Archives Southern Torch

Can I Sell My House With A Tax Lien We Buy Houses Nationwide Usa Cash For Houses Ugly Homebuyers Near Me

Alabama Tax Sales Tax Liens Youtube

2016 Dekalb County Delinquent Tax Notices March 24 T Z Southern Torch

Henrico Va Tax Delinquent Sale Of Real Estate

Alabama Property Tax Calculator Smartasset

Payyourpropertytax Com Dekalb County Property Tax

Delinquent Property Tax Sale Greene County Ga

How Long Can You Go Without Paying Property Taxes In Texas Nationwide Usa Can I Sell My House With A Tax Lien Sell Property For Cash Even If You Owe

Hamblen County Tennessee Property Taxes 2022

Delinquent Property Tax Dekalb County Ga

How To Find Tax Delinquent Properties In Your Area Rethority

Delinquent Property Tax Dekalb County Ga

Georgia Property Tax Liens Breyer Home Buyers