how to find out why i have a tax levy

A lien is not a levy. A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer an individual or legal entity by a governmental organization in order to fund government spending and various public expenditures regional local or national and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount.

Hong Kong S Tax System Explained Why Levies Are So Low How It Competes With Singapore And Why It S Both Out Of Date And Ahead Of Its Time South China Morning Post

Small Business Administrations Paycheck Protection Program PPP is providing an important lifeline to help keep millions of small businesses open and their workers employed during the COVID-19 pandemicMany borrowers will have these loans forgiven.

. It may be up to the amount of MLS. If youre liable for MLS because your spouse has shown a lump sum payment in arrears in their tax return at either Foreign income or Other income you may be entitled to a tax offset. As you can see opening the Notice of Intent to Levy letter and responding within 30 days time will save you time money and many headaches.

Importantly the money in your third pillar does not count towards your wealth tax. Use the Withholding lookup tool to quickly work out the amount to withhold XLSX 34KB This link will download a file. With their services you can avoid lengthy processes of.

Contact Tax Industry to Find Out How Much You Owe. Working with a tax liability professional is the simplest way to determine your total debt. A levy actually takes the property to pay the tax debt.

The levy only applies in areas where a local authority has consulted on and approved a charging schedule which sets out its levy rates and has published the schedule on. You have completed the Medicare levy surcharge section. Eligibility for forgiveness requires using the loan for qualifying purposes like payroll costs.

If you have significant debts including a mortgage then this will reduce your wealth tax. The wealth tax is calculated by your total assets minus your total debts. You should use this table if you make any of the following payments on a fortnightly basis.

For payments made on or after 13 October 2020. In return levy notice recipients must freeze your account or pay the IRS all or a part of your wages or money owed to you. We use this information to work out any Medicare levy surcharge for you.

A lien secures the governments interest in your property when you dont pay your tax debt. If you dont pay or make arrangements to settle your tax debt the IRS can levy seize and sell any type of real or personal property that you own or have an interest in. At Tax Industry we have a team of experts specialized in tax resolution.

Look I just clicked on this article to find out about my mortgage can you speak English.

Tax Levy Understanding The Tax Levy A 15 Minute Guide

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Understanding Your Property Tax Bill And The Services Supported

Irs Notice Cp91 Intent To Seize Social Security Benefits H R Block

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

About Your Property Assessment Tax Rate And Tax Notice District Of North Vancouver

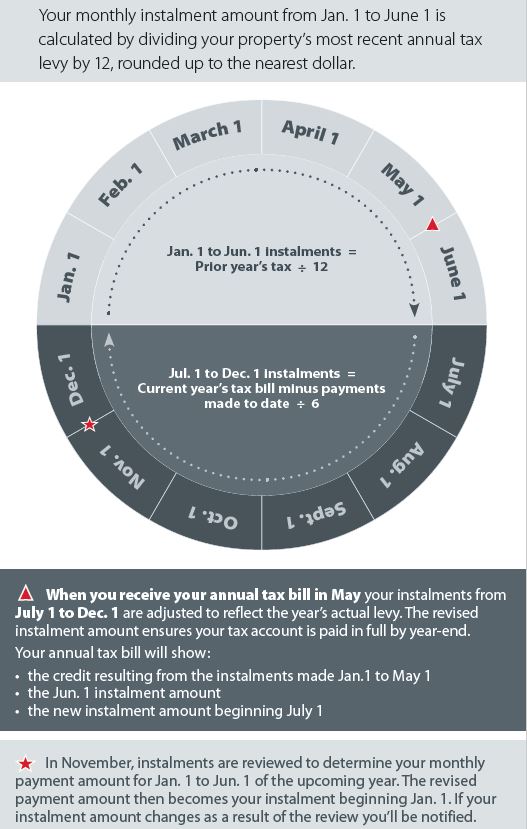

Understanding Your Property Tax Bill City Of Hamilton Ontario Canada

Understanding Your Property Tax Bill City Of Hamilton Ontario Canada

Provincial Land Tax Reform Overview Of The Provincial Land Tax Open Houses

Tax Levy Understanding The Tax Levy A 15 Minute Guide

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Tax Levy Understanding The Tax Levy A 15 Minute Guide

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Tax Levy Understanding The Tax Levy A 15 Minute Guide

Tax Levy Understanding The Tax Levy A 15 Minute Guide

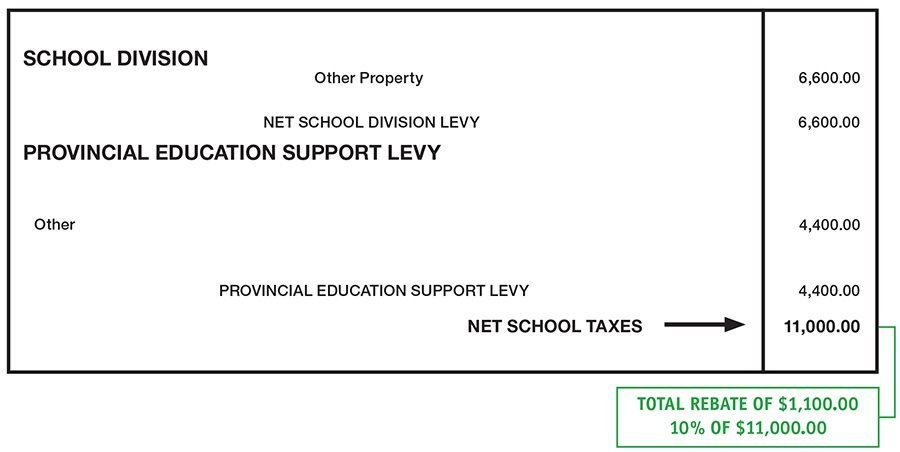

Provincial Education Property Tax Rebate Roll Out Rural Municipality Of St Clements